Know the Difference Between Pro Forma invoices and Tax invoices

Invoicing is an important aspect of any business. It serves as a method of communication between the vendor and the buyer, facilitating and maintaining smooth commercial transactions.

If you own a company and want to create financial credibility, you must have a thorough understanding of invoices. An invoice is an excellent method to package the services or products that your firm offers to a consumer. It can also be used as a transaction record for you and your customer.

But what if you don't know about it? Before completing a purchase, a customer may request that you issue a Pro Forma Invoice, which might place you in a tough position if you are unfamiliar with the term.

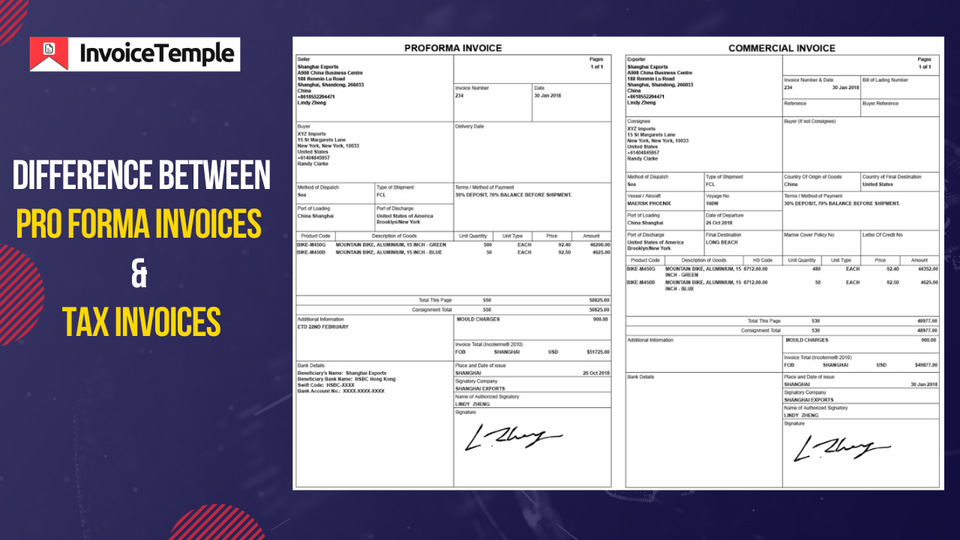

Here are the differences between a Pro Forma Invoice and a Tax Invoice.

So let us get started.

What is a Pro Forma Invoice?

A Pro Forma Invoice is an initial invoice generated by the seller to provide the buyer with important information about the products. Keep in mind that certain items have not yet been sold. The invoice estimates the cost of the items and indicates how much a buyer must expect to pay.

It comprises a summary of an agreement between two parties, as well as its terms, and can be used to expect future sales. It serves as a temporary document that declares to the buyer that the items are priced within the stated range. It is also negotiable.

The purpose of a Proforma Invoice

A Pro Forma Invoice is intended to present the buyer with an expected cost of the products. It also allows the buyer to understand the contents of the goods before making a purchase.

When is a Pro Forma invoice generated?

A Pro Forma Invoice is commonly regarded as a business proposition in which a seller offers its services to a prospective buyer. It is typically used before a purchase is made or when there are no thorough conversations regarding what will happen next.

Contents of a pro forma invoice

GST requires a Pro Forma Invoice to include the following details:

- Date of Issue

- Address and GSTIN of the supplier

- Address and GSTIN of the buyer

- Description of the goods/services, including quantity, unit price, HSN/SAC codes, and taxes (CGST, SGST, and IGST).

- Terms of the pro forma invoice

- Terms of payment

- The validity term of the proforma invoice

- Bank data of the supplier (Account Number and IFSC Code)

- Authorized Signature of the Supplier

What is a Tax Invoice?

A tax invoice is a legal document that the supplier sends to the client as a request for tax-inclusive payment for the sale of goods and services. It covers the quantity, prices, discounts, credits, descriptions, taxes, and total amount paid for products and services. The invoice serves as proof of supply because products are delivered on the invoice issuance date or payment receipt date, whichever is earlier.

Section 31 of the CGST Act requires every registered GST taxpayer to provide tax invoices at the time of supply. The invoices are useful for financial reporting, whether monthly, quarterly, or annual. They are submitted to the tax authorities at the end of the financial year.

The purpose of a Tax Invoice

Customers can receive an input tax credit on different taxes (GST, VAT, or HST) if their goal is to resell the items they purchase. Tax-registered buyers require it to determine the time limit for taxable suppliers and to claim input tax deductions on purchases. In the case of unregistered suppliers, the customer must provide a tax invoice and payment voucher.

Similar to a proforma invoice, invoice production software programs provide customized templates for tax invoices in many industry/business categories. The accounting software calculates taxes based on the date of the tax invoice. Such solutions increase the efficiency of invoice preparation while reducing manual work.

What Is Included in the Tax Invoice?

A tax invoice usually contains the following:

- The term "tax invoice"

- Tax invoice number.

- GSTINs of suppliers and buyers

- Supplier's name, address, and contact information

- Customer's name, address, and contact details

- The date the invoice was issued

- Description and quantity of services or items sold

- Tax rate, amount, and HSN/SAC code

- Price per unit, discount applied, total amount

- Signature of the authorized signatories

Proforma Invoice vs. Tax Invoice: Comparison Table

Conclusion

We hope this blog post helped you understand the relevance, purpose, and use of invoices, as well as what they are. Invoices not only help you manage your business smoothly and efficiently, but they also provide a clear record of transactions. By keeping track of your business profits and expenses, invoices allow you to establish better strategies for increased revenue and long-term growth.